Having no control over one’s spending habits can easily derail their personal finances and prevent them from achieving their long-term goals. Unfortunately, kicking the habit is not an easy thing to do for some. That doesn’t mean it’s totally impossible though.

Here are some small changes a person can make, according to the consumer finance magazine What Investment writer John Elmore, that will lead to positive development in the long run.

A Little Self-Evaluation

One can’t begin making changes when they don’t have a clear idea of their financial situation. Thus, they need to do some evaluation first before coming up with a long-term plan. Do this by taking note of all the money that is coming in and being spent. This means accounting for exactly where and how much of one’s earnings are going.

Considering All Options

Travel with a little less guilt and be sure to look for the best deals on plane tickets

Being more financially responsible doesn’t mean putting a stop to all spending. What a person can do is ensure that they are aware of all of the options available to them before paying for a product or a service. Using comparison sites is always a good idea as they conveniently compile deals and prices in one place to help people get the best one that’ll fit their needs.

Cutting Back on Expenses

Watch out money-saving deals during your weekly trip to the grocery store

In connection with keeping an eye out for deals, an individual should also practice this when making regular everyday purchases. This could be done by finding shorter routes when commuting to and from work or taking an indirect route when traveling.

Also, don’t be afraid to get creative or put in the extra effort. In the end, the savings from seemingly little thrifty practices will add up in one’s bank account.

Getting Disciplined

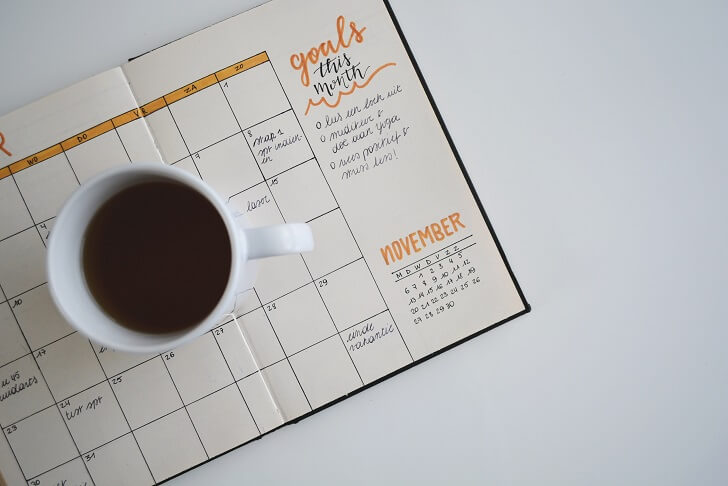

Having specific goals to achieve will encourage you to be stricter with your spending habits

Of course, these habits would hopefully also instill some sense of discipline in a person when it comes to their spending. Another way to do so is by making a savings pot and setting some goals to look forward to.

These can be anything from saving up enough to afford a well-deserved vacation or pulling together enough cash to finally set down a downpayment for one’s first home. One can also impose a rule on themselves to only use their credit card to buy things that are necessities.

Ask for Help

And lastly, don’t be afraid to ask for help with money troubles. Even simply sharing about one’s financial woes to another person will make them feel a bit better about their situation. Receiving some advice from people who have gone through a similar experience will also be helpful.

Aside from friends and family members, one can also turn to certain institutions like StepChange that are dedicated to helping people who may be in debt.