When you decide to purchase a car, you apply for car financing. If the balance is unpaid by the time you need another vehicle, you would not want to be in possession of two cars with an outstanding loan on each. In such a circumstance, you may opt to transfer the car loan to another person.

There are basically two methods by which you can transfer the car loan: either modifying the existing loan with your lender or seek a new lender altogether. If you decide to modify the car loan with your existing lender, you will not be penalized heavily for the same. However, it is not likely to be the same for the new borrower who may not get a good deal. If you seek out a new lender, you will incur some costs, but the new borrower will benefit. You need to decide on your priorities before making a choice.

Modifying The Car Loan Directly

Modifying The Car Loan Directly

If you decide to modify the car loan directly, you need to contact your lender and inform them of your decision to sell the car. Also, notify them that you would like the loan to go with the car. This is usually the practice that is adopted if you decide to trade in your car with a dealership before completing the repayment. However, you need to prove that the new borrower is indeed creditworthy. To ensure that the transfer goes smoothly, the new borrower's credit score should be equal to yours or even better. The entire loan on the car will be transferred to the new borrower, making it seem like you have never borrowed a car loan.

If you decide to modify the car loan directly, you need to contact your lender and inform them of your decision to sell the car. Also, notify them that you would like the loan to go with the car. This is usually the practice that is adopted if you decide to trade in your car with a dealership before completing the repayment. However, you need to prove that the new borrower is indeed creditworthy. To ensure that the transfer goes smoothly, the new borrower's credit score should be equal to yours or even better. The entire loan on the car will be transferred to the new borrower, making it seem like you have never borrowed a car loan.

Finding A New Lender For The Car Loan

Finding A New Lender For The Car Loan

When you decide to seek a new lender, they will offer to pay off the remaining balance on your loan and issue a fresh loan to you. The payment of your existing loan will be considered as a prepayment and could attract penalties from your existing provider and affect your credit scores. However, you will benefit by obtaining a car loan if the outstanding balance is smaller than the initial principal. You can receive lower monthly payments, lower interest rates, and other benefits as well from the lender.

Changing The Car Title

Changing The Car Title

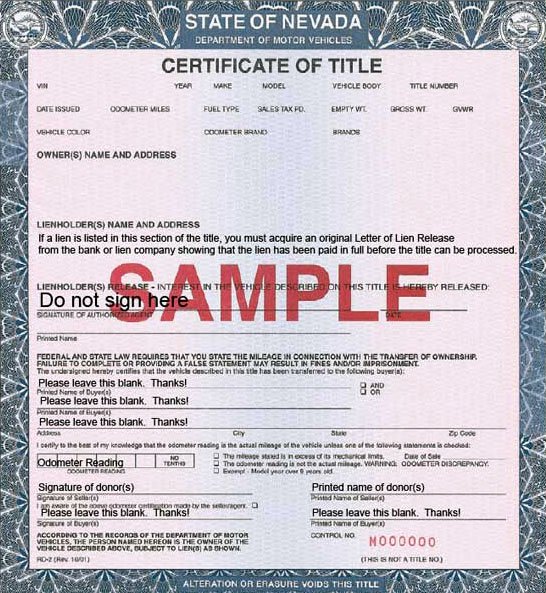

When you decide to transfer the car loan, you must also ensure that you transfer the documents of the car as well. The title of the car can be changed at your local DMV. The procedure for changing the title of the car may differ from state to state. Since you are transferring the car loan, you must also ensure that the lienholder on file is changed. In most cases, lenders will handle this part by themselves.

When you decide to transfer the car loan, you must also ensure that you transfer the documents of the car as well. The title of the car can be changed at your local DMV. The procedure for changing the title of the car may differ from state to state. Since you are transferring the car loan, you must also ensure that the lienholder on file is changed. In most cases, lenders will handle this part by themselves.

Meeting Insurance Requirements

Meeting Insurance Requirements

Transferring your car loan does not end your responsibility because you also need to ensure that the new borrower meets the insurance requirements as specified by the lender. Lenders should be able to give you information about this matter if you have a question. However, it is your responsibility to ensure that the new owner is listed on the insurance policy solely because you wouldn't want to be responsible for the premiums. At the same time, the insurance company may decide to charge higher premiums if the new owner is below the age of 25.

If you no longer want the car on which you had obtained a loan, you can have the car loan transferred to the buyer using any of the above options.