If you’re thinking about the best way to become wealthy and you are scratching your head while thinking, annoyed that you don’t have a good plan, here are some good news for you. More often than not, the simplest habits pay off if they’re properly implemented. The most important thing when it comes to saving money is always to discipline yourself.

[su_quote class="cust-pagination"]“A man is rich in proportion to the number of things which he can afford to let alone.” ― Henry David Thoreau [/su_quote]

If becoming wealthy is something you’re interested in, here are ten habits that will help you achieve your goal.

Never operate at a loss

pathdoc/Shutterstock

The first and the simplest step may seem ridiculous to some, but many people spend more money than they make. As such, they survive the difference by charging their credit cards, digging themselves into deeper debt every step of the way. They believe that they’ll soon make enough money to cover the loss they experience, but in reality, even if they make more money, they’ll keep spending more than they earn because they’ve gained the habit. Therefore, keep it simple and be smart; spend only what you make.

Control yourself by placing a personal tax on yourself

See a part of your earnings as a mandatory tax you would have to pay to the government, but instead, open a separate bank account where a percentage of your earnings will automatically be transferred. Moreover, think of this savings account as if it doesn’t exist until you really need it.

sacitarios/Shutterstock

Open an IRA account

The difference between the previously mentioned account and an IRA account is that the latter is intended to be a secondary savings account that is not to be used until retirement. In this account, your money will grow tax-free, and to control you from withdrawing your funds earlier, the bank penalizes you if you do it before the age of 65.

Pay off your credit card

One of the most important and responsible things to do when you’re trying to be financially stable is to pay off your credit cards on time. You should always make financial decisions according to how much you’re making. Therefore, you shouldn’t charge your credit cards more than you’d be able to cover as soon as the bills arrive.

Poring Studio/Shutterstock

Avoid playing the stock market

Unless you’re an expert in the stock market, you should avoid it. Many people think that they can outsmart the stock market, but the truth is that often they don’t even know what they’re doing. It’s gambling if you play the stock market when you’re an amateur, and you might end up losing a lot of money.

Have a side business

Most of the world’s successful people have several side businesses, with the average billionaire having an average of seven sources of income. The way to go about it is to figure out what you can offer to people, which they are ready to pay for and don’t get discouraged if it doesn’t take off right away. All good things require time.

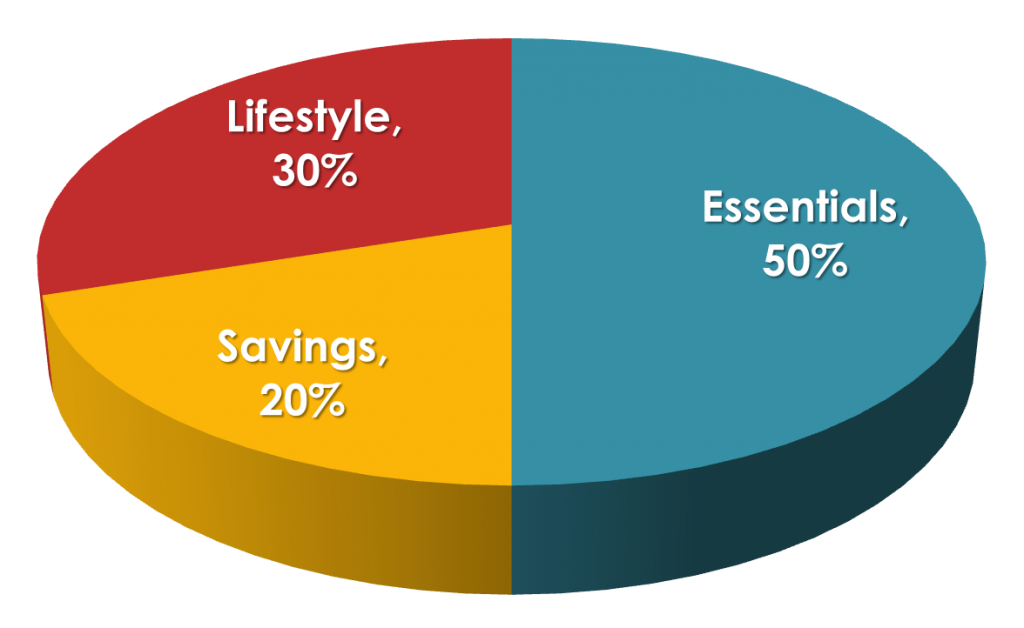

If possible, follow the 50-30-20 rule

Have you ever heard of this rule? It states that you should divide your income and spend 50% of it on essential needs, 30% on luxuries and 20% should be saved. Some follow this rule with the 70-20-10 percentage which is still good, but the 50-30-20 is the best way to go according to experts.

Have you ever heard of this rule? It states that you should divide your income and spend 50% of it on essential needs, 30% on luxuries and 20% should be saved. Some follow this rule with the 70-20-10 percentage which is still good, but the 50-30-20 is the best way to go according to experts.

Set financial goals

When people have a plan, they tend to be more responsible with their money. Problems often arise if you don’t have a plan for some unexpected purchases. Therefore, at the start of each year, you should plan out how you want to spend your earrings.

PhuShutter/Shutterstock

Try surrounding yourself with people who are financially responsible

They say that you become who you surround yourself with. As such, if you want to become financially responsible, surround yourself with people who already are. If your group of friends consists of such people, you are bound to soak up some of their good habits. If you have a family member who is already successful, ask them to mentor you.

Review yourself at the end of every month, but also at the end of the year

It is important to keep tabs on how you’re doing at the end of each month, but it’s also important to look at your overall success at the end of a longer period, and a new year is perfect for that. Some months are better than others, but if at the end of the year you’re profitable, it’s all good.