A study by Northwestern Mutual found that Millennials have debts totaling an average of $36,000 and they spend nearly 34% of their total monthly earnings paying off the debt. The survey revealed that it is almost the same as the exact amount of debt that those who belong to older generations currently have to pay. While baby boomers have a debt which on average totals $39,000, Gen-Xers on average have a debt of $36,000.

However, contrary to how the older counterparts conceive debt reduction, it isn’t necessarily of paramount importance to the millennials. In an inquiry into what occupies the top spot on their list of financial goals, 54% of the respondents of the survey said they were saving so they could have enough to achieve one major milestone. They stated milestones such as getting their own houses or getting or getting married. The number of those who indicated that debt repayment ranked as the top priority was just 49 percent.

Unlike baby boomers and Gen-Xers, millennials do not make debt repayment a top priority

On the other hand, 53% of boomers and 55% of Gen-Xers indicated that debt reduction was a top priority for them.

Financial Priorities For Millennials

Other financial priorities that were popular for millennials included establishment of budget as indicated by 42 percent of the respondents. Also, 13 percent responded that they wanted to review tax strategies and 13 percent also responded that their own top priority was reviewing their contributions to their retirement plan.

Millennials prioritize the establishment of a budget, review of tax strategies and review of contributions to their retirement plan

The report concluded that even though millennials have to deal with the increasing costs of some major expenses such as rent and college they still maintain focus on achieving their goals. Also, they have refused to let the amount of debt they have to repay get in their way.

According to Emily Holbrook, the director in charge of planning at the Northwestern Mutual, millennials have scaled the most essential first step in the process of securing one’s financial future. Holbrook said that the first step is having an understanding that they need to have a plan of in order to achieve their goals. She also added that the next step is ensuring that they are confident in their chosen paths as this would make it possible to navigate their lives based on their personal terms.

Popular Strategies For Debt Elimination

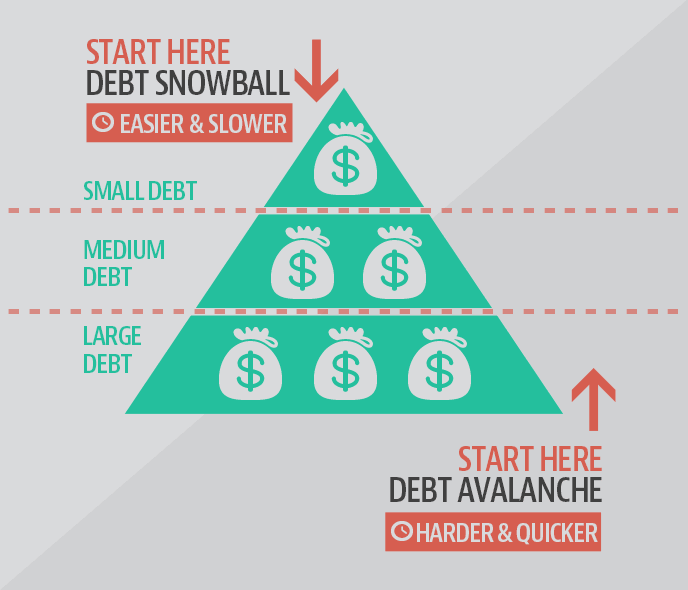

Experts are accustomed to recommending 2 popular strategies to those seeking to eliminate debt. The strategies are the snowball method and the avalanche method.

The popular debt repayment strategies are the snowball method and the avalanche method

Looking at things from a mathematical perspective, the avalanche method is more efficient than the other method. This method operates where a person lists out the debts from the highest to the lowest based on the interest rate. The method posits that you make payment of the minimum balance on all the debts, then subsequently dedicate payment monthly to the debt that has the highest interest rate.

Contrary Opinion On The Most Effective Strategy

It will, however, be interesting to note that Harvard Business Review researchers discovered that the snowball method is, in fact, more effective than the avalanche method because most people find it easier to stick with. This strategy posits that you list out all the debts from the least to the highest then you pay back the minimum balance on all of the debt except the least.

For the debt with the least amount, you dedicate as much cash as you can until you fully repay it. Once that is done, then you proceed to the next debt with the least amount. The researchers noted that the idea behind this is that a person gets motivated as the debts disappear and that helps them to keep repaying the debt. However, the most effective strategy in any case still depends on each individual and it is up to a person to determine what strategy works best.