For so many years now, millions of people managed to get a degree in college in order get a shot at the career they always dreamed off. It all starts with a dream, wherein most parents tell their kids that in order to achieve success and financial freedom in life, they must study hard and finish college. What most kids aren't prepared for is the massive struggle that awaits them once they get enrolled in a college.

Let's be honest, higher education is not cheap. In fact, for many families, enrolling their children in prestigious schools is nothing but a distant, unattainable dream. Once kids graduate from college, they find themselves struggling to pay off their student loans.

In 2018, student loan debt was named the second-highest consumer debt in history, only slightly behind mortgage debt and way higher than auto loan and credit card debt. According to recent statistics, over 44 million Americans now owe about $1.5 trillion, and it averages about $37,000 per student which shows that the debt crisis is only getting worse with time.

The United States is one of the counties which has the highest rate of student loan debt

Student Debt Crisis

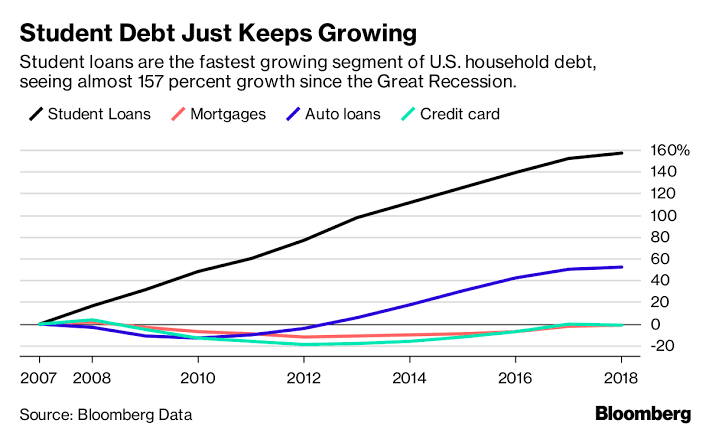

Despite the booming economy that marked the longest bull market in history of the United States, millions of people still worry about their finances, especially their ever-increasing student loans. According to the Federal Reserve, student loans has been consistently at the top of the list for having a continuous cumulative growth ever since the Great Recession.

In fact, over the past 11 years, it has managed to grow over 157 per cent, making it over 50 per cent higher than mortgage, auto loan, and credit card debt collectively. It no longer matters now whether you decide to go to a public or private institution since either way, student debt will most likely follow you unless your parents can afford your education.

College tuition fees continue to rise, but unfortunately that is not the only thing that people who wish to pursue a degree have to worry about. That is because interest rates on student loans are also rising in tandem, and no one can do anything about it. The only way to be able to start paying off the astronomical loans is by getting a job while you’re studying, and based on recent surgery over 85 per cent of college students work full-time and study part-time just to be able to make it through college.

As a parent, you would want to provide nothing but the best for your children, but at the same time you must prepare for your own retirement funds hence there is very little you can do to help them out. However, you can help by having enough knowledge about personal finance and give them tips when it comes to finding the best student loan options out there. Just going through college brochures isn't going to be enough and you may need to do research and calculations of your own.

Chart showing the increase in student loan debt over the years

What Your Child Needs To Know

They very first thing your child needs to figure out how much they will need to cover the tuition fees for their degree, as well as how much they think they will earn during their first year of work. You may need to do research on that one depending on the kind of career your child is pursuing. Another important thing to look into before deciding is how much the monthly payment for the loan will come out to be.

Keep in mind that the longer the repayment period will be, the smaller monthly payments your child will need to worry about. However, this also means that you will pay more when it comes to interests, and you’ll also be in debt for a longer period of time. Whereas if you pay more every month, it'll be much faster for your child to get out of debt. This is one of the toughest decisions when it comes to paying off a loan, hence it must be thought of a hundred times so that you will not regret it in the end.

Students who got federal loan often gets another loan from private lenders

It is also best to find out which is more suitable for you, a private loan or a federal loan. It is a known fact that a federal loan is funded by the government, and the amount is usually limited. There are certain restrictions unlike with the private loans that are funded by banks and credit unions. Some of the private loans don’t have that much restrictions which makes it a better option for some borrowers.